Systemic Risks

Modeling systemic risks

The term ‘systemic risk’ denotes the risk that a whole system consisting of many interacting agents fails. We see systemic risk as a macroscopic property that emerges from the nonlinear interactions of agents.

This differs from a conventional view that focuses on the probability of single extreme events, e.g. earthquakes or big meteors hitting the earth, that seriously damage the system. It also differs from a perspective, for example, used in finance, where a single agent is big enough to damage the whole system - which leads to the notion of systemic importance.

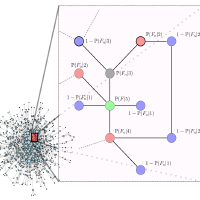

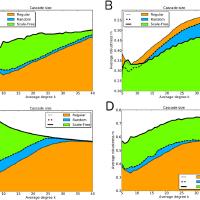

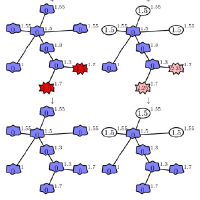

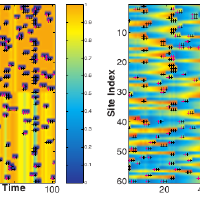

In addition to all these ingredients, our systemic perspective emphasizes the impact of individual failure exerted on other agents. I.e., the systemic failure can start with the failure of a few agents which is amplified both by interaction mechanisms and by systemic feedback. This can lead to failure cascades which span a significant part of the system.

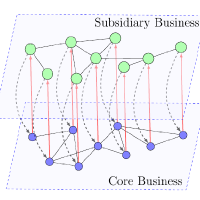

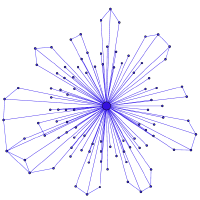

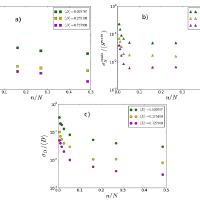

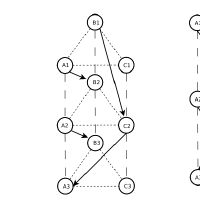

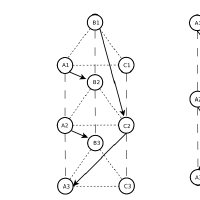

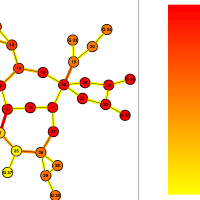

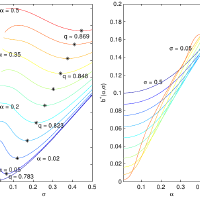

We provide a general framework for modelling systemic risk which was first applied to fully connected networks and is being extended to networks with arbitrary degree distribution from a formal theoretical point of view. Since we also allow for nodes to have heterogeneous robustness, various applications and extensions of the existing models are possible. They include credit networks, supply networks or social online networks where cascades of leaving users may threaten the existence of the platform.

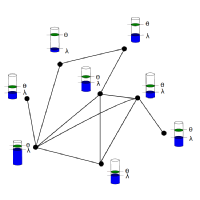

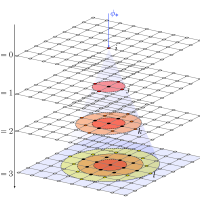

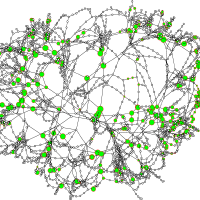

Our approach is based on the concept of complex networks, where agents are represented by nodes in a network, whereas their interactions are modelled by links between them. Both nodes and links can follow their own dynamics and influence each other by feedback effects. In order to understand the emergence of systemic risk, we have to model (a) the internal dynamics of the agents, which is largely neglected in other approaches, (b) the interaction dynamics of the agents (in particular the network topology), (c) macroscopic or systemic feedback, i.e. the impact of changing external conditions, (d) trend reinforcement, i.e. the fact that interactions are path dependent and depend on the history of previous interactions.

Related Publications

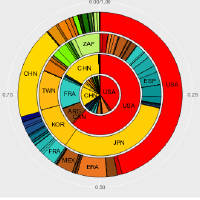

International crop trade networks: The impact of shocks and cascades

Environmental Research Letters - 2019

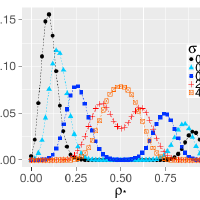

Explicit size distributions of failure cascades redefine systemic risk on finite networks

Scientific Reports - 2018

Correlations between thresholds and degrees: An analytic approach to model attacks and failure cascades

Phys. Rev. E - 2018

A framework for cascade size calculations on random networks

Physical Review E - 2018

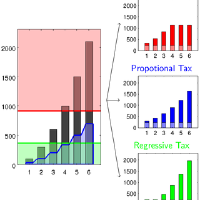

How damage diversification can reduce systemic risk

Physical Review E - 2016

Systemic risk in multiplex networks with asymmetric coupling and threshold feedback

Physica D - 2016

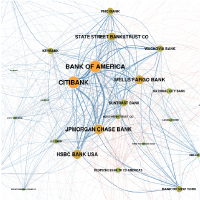

The Network of Counterparty Risk: Analysing Correlations in OTC Derivatives

PLOS ONE - 2015

Quantifying the Impact of Leveraging and Diversification on Systemic Risk

Journal of Financial Stability - 2014

How big is too big? Critical shocks for systemic failure cascades

Journal of Statistical Physics - 2013

Redistribution spurs growth by using a portfolio effect on risky human capital

PLOS ONE - 2013

On the Benefits of Risk Diversification: The Individual and Social Perspectives

SAFE Conference - 2013

Default Cascades in Complex Networks: Topology and Systemic Risk

Scientific Reports - 2013

Bootstrapping Topological Properties and Systemic Risk of Complex Networks Using the Fitness Model

Journal of Statistical Physics - 2013

DebtRank: Too Central to Fail? Financial Networks, the FED and Systemic Risk

Scientific Reports - 2012

Market Procyclicality and Systemic Risk

SSRN Electronic Journal - 2012

Liaisons Dangereuses: Increasing Connectivity, Risk Sharing, and Systemic Risk

Journal of Economic Dynamics and Control - 2012

Default Cascades: When Does Risk Diversification Increase Stability?

Journal of Financial Stability - 2012

Statistical classification of cascading failures in power grids

2011 IEEE Power and Energy Society General Meeting - 2011

Controlled Tripping of Overheated Lines Mitigates Power Outages

2011

Diversification and Financial Stability

SSRN Electronic Journal - 2011

Systemic risk in a unifying framework for cascading processes on networks

The European Physical Journal B - 2009

Systemic risk in a network fragility model analyzed with probability density evolution of persistent random walks

Networks and Heterogeneous Media - 2008

Trade Credit Networks and systemic risk

Understanding Complex Systems - 2008

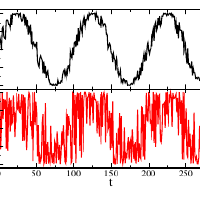

Risk-seeking versus risk-avoiding investments in noisy periodic environments

International Journal of Modern Physics C - 2008