On the Benefits of Risk Diversification: The Individual and Social Perspectives

Paolo Tasca and Stefano Battiston

SAFE Conference (2013)

Research: Systemic Risks

Abstract

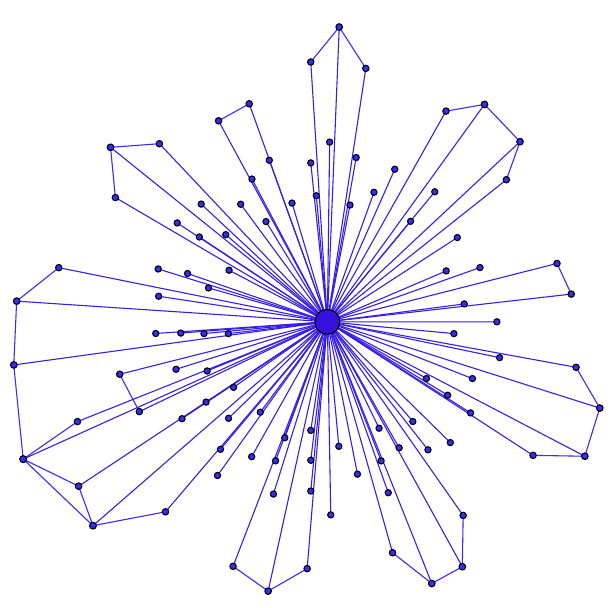

The recent credit crisis of 2007/08 has raised a debate about the so-called knife-edge properties of financial markets. The paper contributes to the debate shedding light on the controversial relation between risk-diversification and financial stability. We model a financial network where assets held by borrowers to meet their obligations, include claims against other borrowers and securities exogenous to the network. The balance-sheet approach is conjugated with a stochastic setting and by a mean-field approximation the law of motion of the system's fragility is derived. We show that diversification has an ambiguous effect and beyond a certain levels elicits financial instability. Moreover, we find that risk-sharing restrictions create a socially preferable outcome. Our findings have significant implications for future policy recommendation.