Risk-seeking versus risk-avoiding investments in noisy periodic environments

Jesus Emeterio Navarro - Barrientos, Frank Edward Walter and Frank Schweitzer

International Journal of Modern Physics C (2008)

Research: Systemic Risks

Abstract

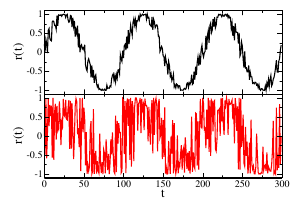

We study the performance of various agent strategies in an artificial investment scenario. Agents are equipped with a budget, x(t), and at each time step invest a particular fraction, q(t), of their budget. The return on investment (RoI), r(t), is characterized by a periodic function with different types and levels of noise. Risk - avoiding agents choose their fraction q(t) proportional to the expected positive RoI, while risk - seeking agents always choose a maximum value qmax if they predict the RoI to be positive (“everything on red”). In addition to these different strategies, agents have different capabilities to predict the future r(t), dependent on their internal complexity. Here, we compare “zero - intelligent” agents using technical analysis (such as moving least squares) with agents using reinforcement learning or genetic algorithms to predict r(t). The performance of agents is measured by their average budget growth after a certain number of time steps. We present results of extensive computer simulations, which show that, for our given artificial environment, (i) the risk - seeking strategy outperforms the risk - avoiding one, and (ii) the genetic algorithm was able to find this optimal strategy itself, and thus outperforms other prediction approaches considered.