Investments in random environments

Jesus Emeterio Navarro - Barrientos, Ruben Cantero, Joao F. Rodrigues and Frank Schweitzer

Physica A (2008)

Abstract

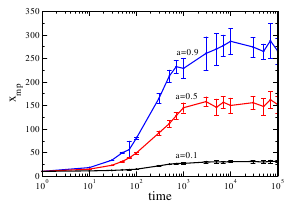

We present analytical investigations of a multiplicative stochastic process that models a simple investor dynamics in a random environment. The dynamics of the investor's budget, $x(t)$, depends on the stochasticity of the return on investment, $r(t)$, for which different model assumptions are discussed. The fat-tail distribution of the budget is investigated and compared with theoretical predictions. Weare mainly interested in the most probable value $x_mp$ of the budget that reaches a constant value over time. Based on an analytical investigation of the dynamics, we are able to predict $x_mp^stat$. We find a scaling law that relates the most probable value to the characteristic parameters describing the stochastic process. Our analytical results are confirmed by stochastic computer simulations that show a very good agreement with the predictions.